Picture this: It’s July 1st. You wake up, check your bank account, and see a cool $1,193,248.20 deposited. For doing… absolutely nothing. No frantic emails, no Zoom meetings, no commute. Just pure, unadulterated financial freedom. Now, imagine this happens every single year on the same date, guaranteed, until you’re 72 years old.

Sounds like a fantasy, right? For retired Major League Baseball player Bobby Bonilla, this is his reality. Welcome to Bobby Bonilla Day, baseball’s quirkiest, most fascinating annual tradition. It’s not just a meme; it’s a masterclass in financial strategy, a stark reminder of a franchise’s infamous miscalculation, and a celebration of deferred gratification that pays off – literally – every summer.

What Is Bobby Bonilla Day? The $29.8 Million Payout

Every year on July 1st, the New York Mets cut Bobby Bonilla a check for $1,193,248.20. This has happened annually since 2011 and will continue until 2035. By the time the final payment is made, the Mets will have paid Bonilla $29.8 million for a player who last wore their uniform in 1999.

Hold on. Bobby Bonilla retired in 2001. Why is he still getting paid more than two decades later, and significantly more than the original amount owed? The answer lies in a perfect storm of deferred money, compound interest, and one of the most infamous financial scandals in history.

Rewinding to 1999: The Deal That Started It All

Let’s set the scene. It’s 1999. Bobby Bonilla, a 6-time All-Star with a powerful bat and sometimes controversial clubhouse presence, is in the final year of a 5-year, $29 million contract with the Mets. He’s 36, his performance is declining (.160 batting average that season), and he’s become unpopular with fans and management. The Mets want him gone.

They still owe him $5.9 million for the 2000 season. The standard move? Buy out the contract for a lump sum, maybe slightly discounted. But Bonilla’s agent, the legendary Dennis Gilbert, had a different idea: Defer the payment. With interest. A lot of interest.

The Mets Say “Yes”: A Perfect Storm of Factors

Why on earth would the Mets agree to this? Two key reasons:

- The Bernie Madoff Mirage: Mets owner Fred Wilpon and his partner, Saul Katz, were heavily invested with Bernie Madoff. At the time, Madoff was reporting impossibly consistent, high returns (later revealed as history’s largest Ponzi scheme). Wilpon believed his investments with Madoff would easily generate returns far exceeding the 8% interest rate Gilbert demanded on Bonilla’s deferred money. Essentially, they thought they could invest that $5.9 million with Madoff, earn more than 8%, pay Bonilla later, and still profit. It was pure financial hubris.

- Luxury Tax Relief (The Steve Phillips Factor): Mets GM Steve Phillips was keen to free up immediate payroll for the 2000 season to make a run at star pitchers and avoid the newly implemented Competitive Balance Tax (luxury tax). Deferring Bonilla’s $5.9 million hit cleared that space instantly. Phillips later admitted the Madoff returns heavily influenced the decision, calling it a “no-brainer” at the time.

The Deal Struck (November 3, 1999):

- The Mets deferred paying the $5.9 million owed for 2000.

- Instead, they agreed to pay Bonilla $1,193,248.20 every July 1st from 2011 until 2035 (25 payments).

- The interest rate? A whopping 8%, compounded annually.

The Power of Compound Interest: Turning $5.9M into $29.8M

This is where the math gets eye-popping. An 8% annual return, compounded over a decade before payments even started, is incredibly powerful.

- Original Amount Owed (2000): $5.9 Million

- Deferral Period (2000-2010): 11 years of 8% interest compounding annually on the $5.9M.

- Value in 2011: By the time the first payment was due in 2011, the initial $5.9 million debt had ballooned to approximately $15.16 million due to that 8% compound interest.

- Paying it Off: That $15.16 million was then paid out in 25 equal annual installments of $1,193,248.20. ($15.16M / 25 ≈ $606,400, but the payments include continuing interest accrual on the remaining balance each year, resulting in the higher final figure).

Financial Expert Insight: “This deal is a textbook case study in the time value of money and the power of compound interest,” says Dr. Andrew Zimbalist, renowned sports economist and author. “Bonilla’s agent, Dennis Gilbert, understood that securing a guaranteed, high-interest deferred income stream was far more valuable to his client, given Bonilla’s age and career stage, than a lump sum that could be mismanaged. For the Mets, it was a catastrophic misjudgment fueled by the false security of the Madoff returns.”

Beyond Bonilla: Deferred Money Isn’t Rare, But This Is

Deferred compensation is actually common in baseball (and sports in general). Teams use it to manage cash flow and luxury tax implications. Players sometimes agree to it for tax planning or guaranteed long-term security. Examples include:

- Ken Griffey Jr. (Reds): Receives $3.59 million annually from Cincinnati through 2024 from a 2000 deal.

- Max Scherzer (Nationals): Will receive $15 million annually from Washington from 2022 to 2028.

- Manny Ramirez (Red Sox): Received over $2 million yearly from Boston until 2026.

However, Bobby Bonilla’s deal stands out because:

- The Interest Rate (8%) was exceptionally high, especially for a risk-free, guaranteed return.

- The Length of Deferral (11 years before payments started) allowed that interest to compound massively.

- The Infamous Madoff Connection provides a darkly ironic backdrop.

- The Player’s Performance at the time of the deal (struggling, unpopular) makes the massive payout seem even more incongruous decades later.

- The Perfect Storm of Mets Mismanagement: It symbolizes a period of poor decision-making by the franchise.

Why We Celebrate: More Than Just Mocking the Mets

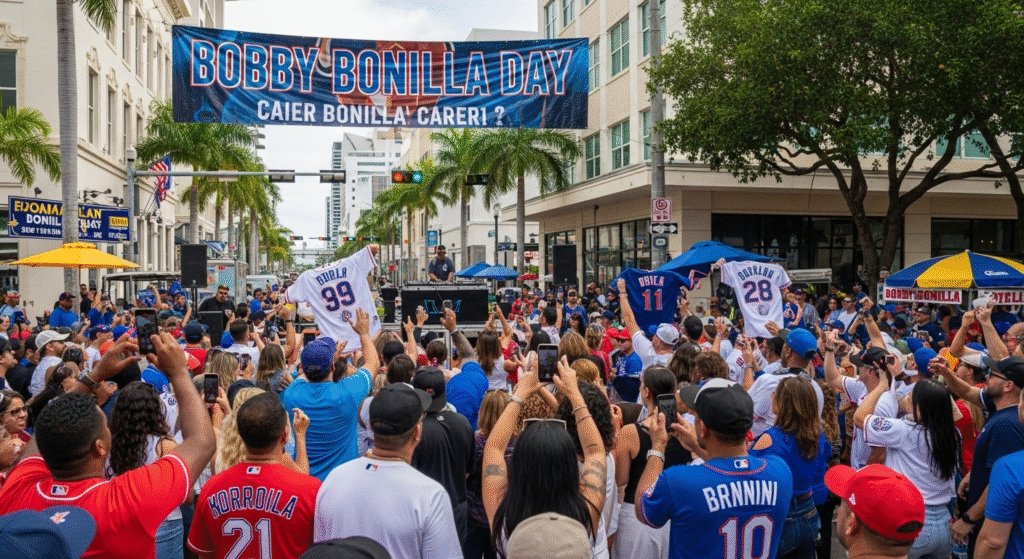

Bobby Bonilla Day (July 1st) has evolved into a genuine cultural phenomenon:

- Mets Fans: Initially a source of frustration, many now embrace the day with dark humor and resignation. It’s a yearly ritual to good-naturedly (or sometimes bitterly) acknowledge the deal. Social media explodes with memes, jokes, and reminders of the payment.

- Baseball Fans & Finance Geeks: It’s a fascinating case study in contract negotiation, financial planning, and the long-term consequences of decisions. #BobbyBonillaDay trends annually.

- Bobby Bonilla Himself: He reportedly loves it. He gets a massive check for doing nothing, and his name becomes nationally recognized one day every year. He’s become the patron saint of deferred compensation. As he once quipped, “It’s a great day. It’s Bobby Bonilla Day!”

- A Lesson in Financial Literacy: It perfectly illustrates concepts like compound interest, net present value (NPV), and the importance of understanding long-term financial implications. “The Bobby Bonilla contract should be taught in every high school economics class,” jokes Molly Knight, sports journalist and author.

Was it Actually a Bad Deal for the Mets? (The Nuance)

Hindsight is 20/20. With the collapse of Madoff’s scheme in 2008, the Wilpons lost hundreds of millions. The assumed returns that made the Bonilla deferral seem smart vanished. Paying nearly $30 million for a player long gone became a glaring symbol of that loss and poor judgment.

However, purely from a 1999 perspective, if the Madoff returns were real (which they weren’t), the math could have worked for the Mets. If they truly earned 10-12% annually from Madoff on that $5.9 million, they could have covered the 8% to Bonilla and still made a profit.

The catastrophic flaw was basing a major financial decision on fraudulent returns. The deal structure wasn’t inherently insane given the Mets’ (flawed) assumptions; the due diligence and underlying investment were the disasters.

The Legacy: Financial Folklore and a Lasting Laugh

Bobby Bonilla Day is more than just an annual payment. It’s:

- A Cautionary Tale: About the perils of risky investments, hubris, and failing to grasp long-term financial consequences.

- A Testament to Savvy Representation: Dennis Gilbert secured an incredible deal for his client, prioritizing long-term security over immediate cash.

- A Unique Piece of Baseball Lore: A quirky, enduring story that blends sports, finance, and scandal in a way no other contract has.

- A Celebration of Guaranteed Income: In an uncertain world, Bonilla’s annual payday represents a unique form of financial security.

- A Unifying (if Mocking) Event: A day when baseball fans, regardless of team allegiance, can come together to acknowledge the sheer absurdity and brilliance of the deal.

So, this July 1st, when you see the tweets and memes flood your feed, remember Bobby Bonilla Day isn’t just about mocking the Mets. It’s a celebration of an unparalleled financial arrangement, a lesson in compound interest, and a reminder that sometimes, the most legendary moments in sports happen off the field, decades after the last pitch is thrown. Raise a glass (or imagine depositing $1.19 million) to Bobby Bo – the man who turned a buyout into baseball’s most lucrative retirement plan. Happy Bobby Bonilla Day!

Pingback: Join Indian Navy as a Musicians 2025 - Trend Alart

Pingback: Liverpool and Portugal forward Diogo Jota died in a car crash. - Trend Alart